The new subprime is in auto loans: One third of all new auto loans are of the subprime variety. Repossession are up 70 percent.

The new-new with subprime

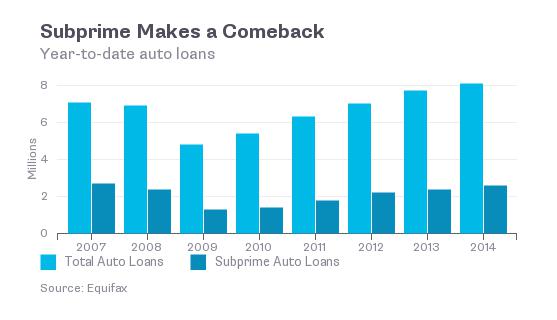

Subprime debt is the new-new in the credit markets. What is telling here is that much of this debt growth has occurred under the umbrella of recovery. If things are going so well, then why are so many loans being made to those with bad credit? Bad credit at least by the measurement tool we use, typically reflects an inability to meet payments or manage money. Yet here we are, expanding more debt to those to lease or purchase cars beyond their means. At least with a home, you had the chance to build some sort of equity but a car loses value the instant you step into the driver’s seat. Take a look at this market:

Notice how the growth is occurring during the supposed recovery? So it should come as no shock that repossession are surging:

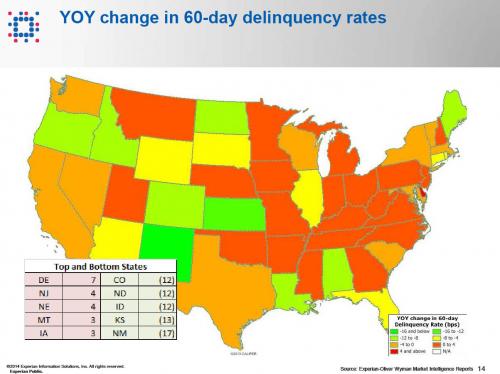

“(NBC News) The repo man is getting very busy as a growing number of car and truck owners are struggling to make their monthly auto loan payments. Experian, which analyses millions of auto loans, said Wednesday that the percentage of those loans that were delinquent or ended up in default with the vehicle being repossessed surged in the second quarter of this year. The rate of repossessions jumped 70.2 percent in the second quarter, with much of that increase coming from finance companies not run by automakers, banks or credit unions. Even with that rise, the percentage of auto loans that end in default is just 0.62 percent of all auto loans.”This is to be expected. Riskier loans. Riskier payoff. And when we look at the underlying data we will find that many states are seeing troubling delinquency rates:

“(Equifax) The total number of new loans originated year-to-date through June for subprime borrowers, defined as consumers with Equifax Risk Scores of 640 or lower, is 3.9 million, representing 31.2% of all auto loans originated this year. This is a slight decrease in share from this same time in 2013.”Essentially a core group of borrowers on new auto loans is coming from the subprime variety. Of course some pundits would like to point out that this is a “small” portion of the total auto loan market. This argument has parallels to what we heard about subprime debt in housing. These are your super marginal borrowers. But don’t think the typical American with a job making roughly $26,000 per year is in good shape either. Problems cascade from the bottom up. The economy for most Americans is struggling so it should be no surprise that the new growth market is subprime auto debt. Now, most can’t afford a home so at least you’ll get a car, even if you can’t afford a car as well.

Source: http://www.mybudget360.com/subprime-auto-loans-new-subprime-debt-repossession/

No comments:

Post a Comment